2%

Share Bonus

Invest $6,250 or more

3.5%

Share Bonus

Invest $12,500 or more

5%

Share Bonus

Invest $25,000 or more

Limited Time Investment Opportunity

At Spirits Capital, we are a fintech company that merges technology with the alternative asset class of premium American whiskey. We've built a platform that provides investors with a secure and transparent way to capitalize on the growth in value of whiskey while it matures in the barrel. In addition, we will soon be launching the Distilled Barrels Financial Exchange (DBFEX), a cutting-edge digital marketplace for the global trading of aged whiskey barrels. DBFEX uses a proprietary AI-driven pricing tool, known as the Barrel Value Optimizer, to analyze an extensive array of market data and barrel-specific information to suggest optimal price ranges for aged whiskey barrels.

Spirits Capital Corporation is a technology-driven sponsor of secured transactions and monetization for the spirits industry.

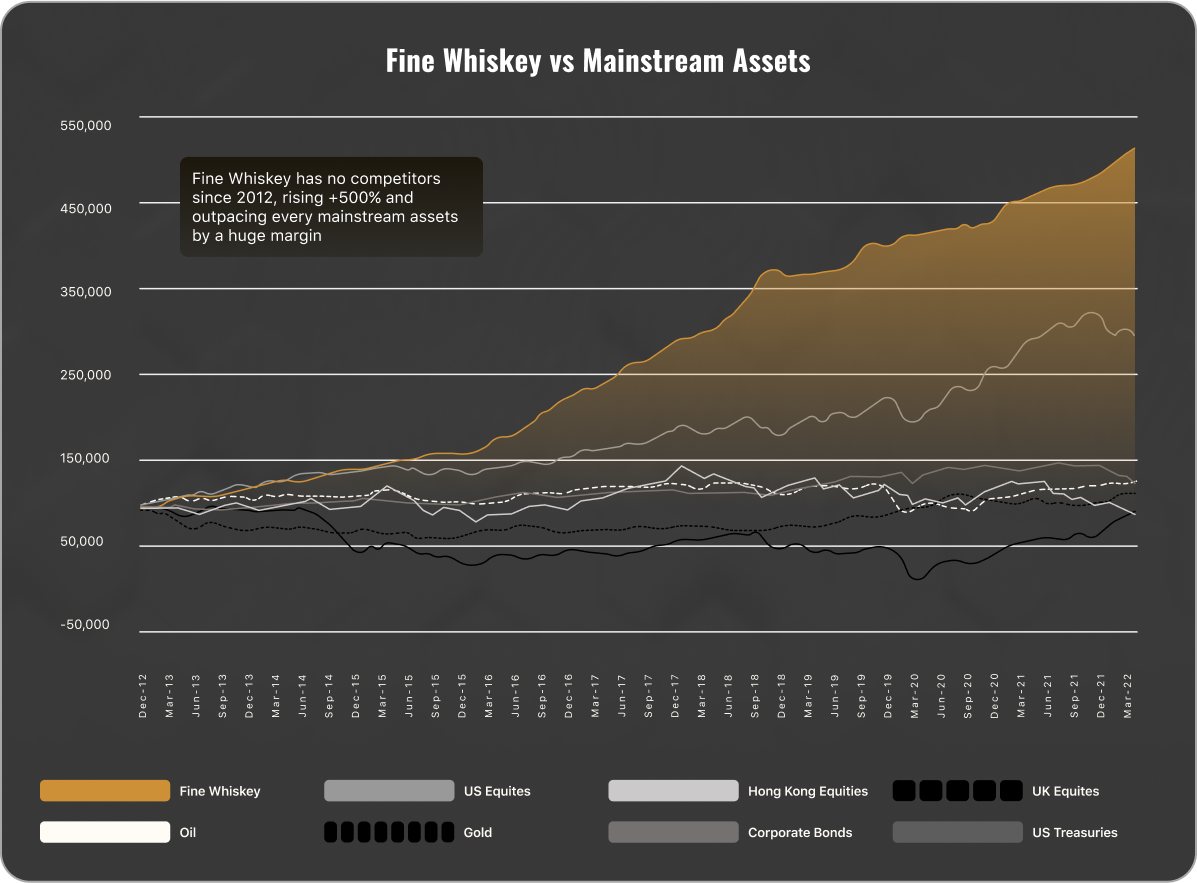

Premium American whiskey not only outperformed the S&P 500 by more 68% over the last 10 years, it also outperformed global equities and other alternative investments while being less volatile.

Our unique and proprietary technology aligns with strong consumer demand for premium distilled spirits, creating an open, safe, and secure marketplace to capitalize on the promising future of Premium American Whiskey.

All valuations are AI-enhanced for peak market precision and integrity.

The American whiskey market is forecasted to grow from $9.2 billion in 2023 to $19.8 billion by 2030.

Whiskey has outperformed the S&P 500 by +68% over the past 10 years.

All Spirits Capital whiskey barrels are backed by premium insurance carriers and certified to the highest industry standards.

Asset-backed alternative investment with double-digit returns

Outperformance over traditional investments and other alternatives

Stable; non-correlated to the markets and less volatile

Recession proof – demand for whiskey is consistent in good and bad times

Inflation hedge

Invest $6,250 or more

Invest $12,500 or more

Invest $25,000 or more

Chairman and CEO Todd Sanders has been involved in the boutique venture capital markets for more than 20 years, during which he consulted dozens of private and public companies with enterprise values of over $4 billion. He assembled a team of professionals who are experts at building companies that create shareholder value.

Everything you need to know about Spirits Capital and Investing. Can’t find the answer you’re looking for? Please contact us

We are currently issuing Common Stock at $1.75 per share.

Anyone over the age of 18 years can invest. This offering is open to both Accredited and Non-accredited investors.

Accredited investors can invest as much as they want. But if you are a NON accredited investor, your investment limit is equal to 10% of the greater of: annual income or net worth (for natural persons), or annual revenue or net assets (for non- natural persons).

(If we are linking the qualifications for an Accr. Inv. above, providing this below is redundant.)

To qualify as an accredited investor, you must have one of the following:

*To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

This raise is currently set at $35,000,000. Offering proceeds will generally be used for product inventory, marketing, offering fees and expenses, and working capital.

For more detail of the company’s expected allocations of the proceeds from this offer you can see page 19 of the Offering Circular, which can be found on our main offering page.

There is no minimum amount set and no provision to escrow or return investor funds. If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering. There is no minimum funding target for this Regulation A+ offering, so all investments will be available to be invested under the conditions of Regulation A Offering Statement filed with the SEC.

Early stage investing provides the opportunity for exponential return on an initial investment. There is risk associated with investing in startup companies, which is why here at Spirits Capital we actively provide insights and transparency to what our company is doing. For personal risk-tolerance assessment or questions, we encourage you to discuss these matters with your trusted financial advisor.

Issuer must file with the SEC annual reports on Form 1-K (with audited financial statements), semi-annual reports on Form 1-SA (with unaudited financial statements) and current reports on Form 1-U. Besides this, the Issuing company will be presenting periodic updates on the company and investors will be notified of these updates.

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

Add Your Heading Text Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua Egestas purus viverra accumsan in nisl nisi